Find a few things odd?

Analysts are paid well over $1 billion every year to write reports on the stocks they cover. Most reports contain a recommendation, earnings estimates, growth estimates, notes on their opinion, a target price, and other fundamental and technical data.

Recommendations or ratings, such as the ones you saw above, are supposed to tell you whether or not you should buy or sell a stock based on an analyst’s research. There are 5 different recommendations: Strong Buy, Buy, Hold, Sell, Strong Sell, with some variation between firms such as Outperform, Market Perform, and Underperform or Overweight, Equal-weight, and Underweight.

Generally, you’ll see a lot more “Buy” ratings than “Sell” ratings due to the fact that analysts are employed by the same investment banks and research firms that do business with the companies that they cover. The last thing a company needs is an analyst crushing their stock (on average 5-10%). Therefore, when an analyst issues a “Hold” rating, it’s really a “Sell” rating in disguise. A downgrade from “Buy” to “Hold” also means “Sell”. When an analyst issues a “Buy” rating that translates into more commission revenue ($$$) for the analysts’ firm. So if you’re an analyst and you want to get paid ($$$), you know what rating to issue.

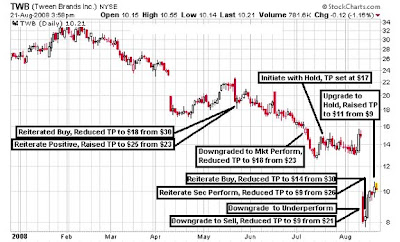

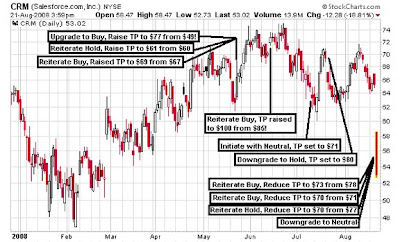

Many recommendations are inaccurate because they rely on a single person’s opinion of a stock. Since we all have our own opinions, why should we listen to someone else’s, even if they work at ABC investment bank? The charts above show how analysts are “too late” in changing their ratings, inaccurate at setting target prices, and issue the wrong ratings at the wrong time.

An Institutional Investor poll was conducted in 2006 to rank, in the order of importance, what attributes they sought after in sell-side analysts (the guys working at the brokerage firm). The result: Of the 12 attributes, stock picking ranked 11th. This is more evidence that analysts, as whole, are not very good stock pickers. Recommendations should not carry too much weight in an investment decision, and any ratings that are issued over 3 months ago are considered worthless.

How about target prices? They’re worthless too. Basically, analysts create a future earnings projection and add a P/E to these “earnings” based on their opinions. Since future earnings cannot be 100% accurately predicted and the market can sometimes become irrational, what does that make target prices out to be? (Not worth following).

We can also see a phenomenon called “herding”. In general terms, herding refers to “following the crowd”. In the case of ratings, many times if an analyst or two upgrade or downgrade a stock, other analysts are highly likely to follow in that same direction. Therefore, be aware of how many analysts are covering a particular stock and compare that to the most recently issued ratings.

Companies report earnings each quarter. The earnings-per-share (EPS) are the “hard numbers” that are not subject to opinion or manipulation (in most cases). Analysts issue earnings estimates before the release of the actual earnings reported by a company. These estimates are important because they quantify what that particular company is likely to earn in the future. The actual estimates are not nearly as important as the change in the overall consensus.

When analysts revise estimates up or down, analysts that are not close to the estimate range will look stupid, therefore, revising their estimates to join the herd. If all the analysts are wrong in their estimates, then the analyst won’t look so bad, another reason to join the herd. The greater the change in the past 30 days vs. 60 days and 120 days, the stronger the signal to buy or sell occurs, depending upon the direction of the revision.

When looking at the actual earnings report of a company, ask yourself two questions:

- Where did the earnings come from?

- Did they come from strong revenue growth, multiple acquisitions, expense cutting, or maybe a few accounting tricks?

- Did management guide analysts lower but reported much “better”, just to beat analyst expectations?

- What is the long-term outlook of the company’s future?

- Did management provide or reiterate guidance for the next quarter and the fiscal year?

- What new changes are planned to occur with the company?

The response to the stock’s price will be determined depending upon the quality of the answers of the two questions.

On a technical note, the majority of breakaway, continuation, and exhaustion gaps occur when earnings are reported pre-market or after-hours. Area gaps usually occur when an analyst’s rating is issued. Breakaway and continuation gaps have the propensity to continue in the direction of the gap for several months (note gaps in the above charts). This is mostly cause by the large institutions buying or selling the stock throughout the period between when earnings are reported and before the next quarter’s earnings are announced. Area gaps tend to fill quickly, in a matter of days, while an exhaustion gap signals a major longer-term reversal.

In conclusion, it is safe to assume that an investor should not focus on recommendations or price targets, but rather the actual reported earnings, and prior to that, the change in the consensus estimate to determine the most likely future direction of a company’s results.