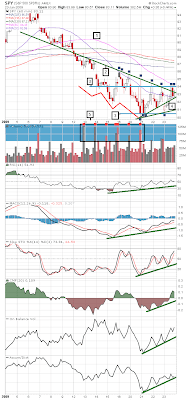

Let's take a look at the SPY for a moment (CLICK to enlarge)

1) Moving Averages

-a) 325-period (blue) = 50-day SMA, resistance

-b) 195-period (red) = 30-day SMA, resistance

-c) 130-period (green) = 20-day SMA, resistance

-d) 65-period (pink) = 10-day SMA, resistance

-e) 32.5-period (purple) = 5-day SMA, support

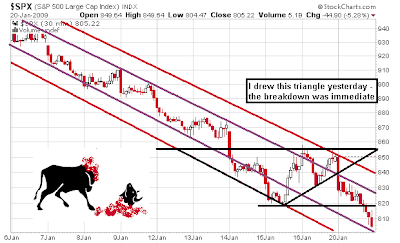

2) Solid green line is intermediate resistance & upper line segment of a symmetrical triangle.

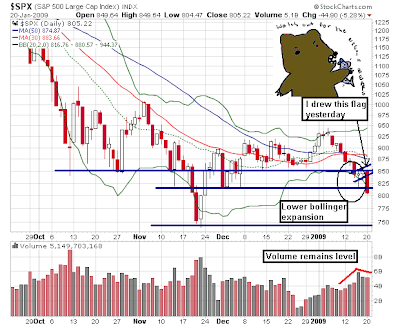

3) Solid sky blue lines at 80.50 and 84 mark the neutral channel (or 805-840 on the SPX).

4) Ascending lower line segments for the symmetrical triangle. Two meeting points, one at 81 and the other at 82.75. Both have been used as support for the past 3 days.

5) Notice the volume spikes on the way down for both positive and negative days in the "blue zone" (75M or more shares or more).

Finally, the various selected indicators below the SPY show an obvious divergence that is positive for the market when using the neutral channel (3). We've gapped down and rebounded for 3 consecutive days on stable volume. I do not know when, but it looks like the market may be setting up for a short-term bounce. I've covered the vast majority of my positions and added some long positions, including oil via DXO (I never trade oil), and hold a large cash position.

My rule right now is to not hold much overnight because 1) we are still in earnings season, 2) this market is once again emotionally-charged and news driven, 3) the uncertainty of the financials doesn't give me much comfort (more immediate bailouts on the way?), 4) overhead resistance, 5) the downtrending sell-off has been halted, 6) the past two days' candles are forming long shadows, or tails (typically bullish), and 7) "WTF" chart patterns have been appearing in the morning, mid-day, and/or end of day, causing extreme whipsaw and headache to traders everywhere.

As you can see, there are too many mixed signals that will kill both bulls and bears if you are not hedged or have an ample cash reserve. There's no rush right now, and I'm not going to rush it. The key right now is capital preservation.

That's all for now. gtg!

Today's Spread Trade Action

Today, an increasingly popular way to grow money is with spread trading. Spread trading allows a trader to profit from both increasing and decreasing moves on a variety of international markets including stock indexes, individual shares, currencies, bonds, and commodities. Profits are 100% tax free!