My grandfather passed away at 8:30AM this morning. Don't take life for granted. I will see you here tomorrow.

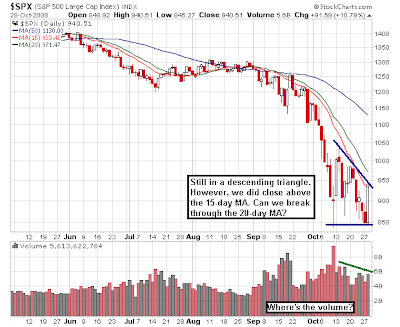

Where Will The S&P 500 Bottom?

17 minutes ago

ATTORNEY GENERAL CUOMO SEEKS BONUS POOL INFORMATION FROM BANKS RECEIVING FEDERAL FUNDS

ATTORNEY GENERAL CUOMO SEEKS BONUS POOL INFORMATION FROM BANKS RECEIVING FEDERAL FUNDS S&P 500 6-month

S&P 500 6-month

S&P 500 1-day

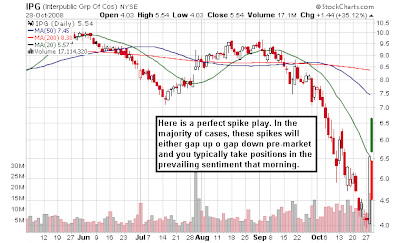

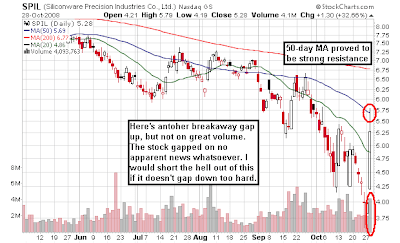

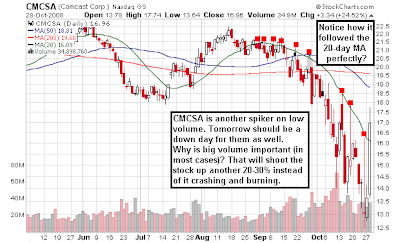

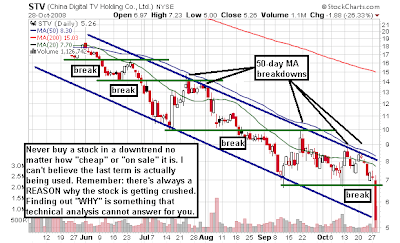

S&P 500 1-dayIn-depth technical analysis on various financial markets with emphasis on short-term trading and the art of charting.